Novated leasing is a flexible way to finance a vehicle using salary packaging. It’s commonly used by employees to access tax benefits, and by employers as a low-cost way to offer valuable perks to their team. In this guide, we break down what a novated lease is, how it works, the pros and cons for both parties, and how it compares to other vehicle and equipment finance options. For businesses, novated leases can also form part of a broader equipment finance strategy, helping support staff and manage vehicle-related costs more effectively.

Navigating this guide:

- What is a Novated Lease?

- How Does a Novated Lease Work?

- Novated Lease Pros & Cons

- What Is a Self-Managed Novated Lease?

- What Happens at the End of a Novated Lease?

- How Novated Leases Compare to Other Equipment Finance Options

- How to Take the First Step With a Novated Lease

What is a Novated Lease?

A novated lease is a type of salary packaging (i.e. a salary sacrifice arrangement) that allows an employee to lease a car using their pre-tax income, with support from their employer. It’s a three-way agreement between the employee, employer, and a finance company where an employee is sacrificing part of their salary in return for the benefit of a vehicle.

From the employee’s perspective, this arrangement means they are paying for their car out of pre-tax income, which can significantly reduce their taxable salary and save them money. From the employer’s perspective, novated leases are a way to provide a valuable benefit to staff without the company directly and entirely paying for the vehicle.

How Does a Novated Lease Work?

For the Employer

From an employer’s perspective, implementing a novated lease is a simple process, especially with the right support.

You will usually need to sign a deed of novation with the finance provider and the employee, which is the document that “novates” (transfers) the lease obligations to you while the employee is on your payroll. Once this is in place, here’s how it works:

As an employer, your role in a novated lease is largely administrative and low risk:

- Payroll deductions. You deduct lease and running costs (fuel, rego, insurance, etc.) from the employee’s gross salary and forward payments to the finance provider.

- Fringe benefits tax handling. Most novated lease arrangements are structured so that you, as the employer, do not end up out of pocket for any Fringe Benefits Tax (FBT). Commonly, the arrangement uses the Employee Contribution Method (ECM), where a portion of the costs are deducted from the employee’s post-tax income to offset any FBT liability.

- Administration requirements. You handle some administration in setting up the arrangement (signing the agreement, adjusting the payroll system to do the deductions, and annual FBT reporting if required). However, the admin burden is typically low, especially if you partner with a novated lease provider or broker.

- Cost to the business. The lease payments come from the employee’s salary. There’s no impact on your balance sheet because the vehicle is not an asset or liability of the business.

- Risk. Should the employee leave your company or change jobs, the novation agreement is typically terminated (often automatically) and the lease obligation reverts back to the employee.

For the Employee

As an employee, a novated lease allows you to finance and run a car using your pre-tax salary, with your employer’s assistance. Your responsibilities include:

- Choosing a car and finance: You select the vehicle you want (within any guidelines set by your employer). You then arrange the lease through a finance company or broker/lease provider.

- Signing the agreements: Once approved, you sign a lease agreement for the car and also sign the novation agreement, which your employer will co-sign.

- Salary sacrificing: Your gross salary is then reduced by the amount of the lease repayment and any included running costs. You may also have an agreed portion taken from post-tax pay to account for Fringe Benefits Tax*

- Using and maintaining the car: You are responsible for the car’s use and upkeep, but many lease packages (especially if it’s a fully maintained novated lease) will cover routine expenses.

- Leaving the job: If you leave your employer, you keep the car and the lease. You can continue the lease payments directly from your own bank account (now using post-tax income) or, if your new employer agrees, you can re-novate the lease with them to maintain the tax benefits.

How to Get Started

To apply for a novated lease, employees will need to complete a credit application with the finance company. They will ask you for details about your income and expenses, and perform a credit check. The finance company will then liaise with your employer to set up a lease agreement and a deed of innovation. The novated lease agreement will include details such as the term of the lease, the estimated number of kilometres you expect to travel annually, the rental amount, and the type of car.

How to Avoid Fringe Benefits Tax for Employees

A novated lease is considered to be a fringe benefit outside of your cash salary or wages and is therefore subject to Fringe Benefit Tax. However to counteract any Fringe Benefit Tax liable on your novated lease, your deductions can be set up to include a portion of your post-tax salary. By paying in this way, which is known as the Employee Contribution Method, you reduce the taxable value of the car which in turn reduces the Fringe Benefits Tax to zero.

Salary packaging options like novated leases are usually more effective for people on middle to high incomes. Check with your employer to find out what salary packaging options they offer. You may choose to get professional tax advice before entering into a novated lease or other salary packaging.

Novated Lease Pros & Cons

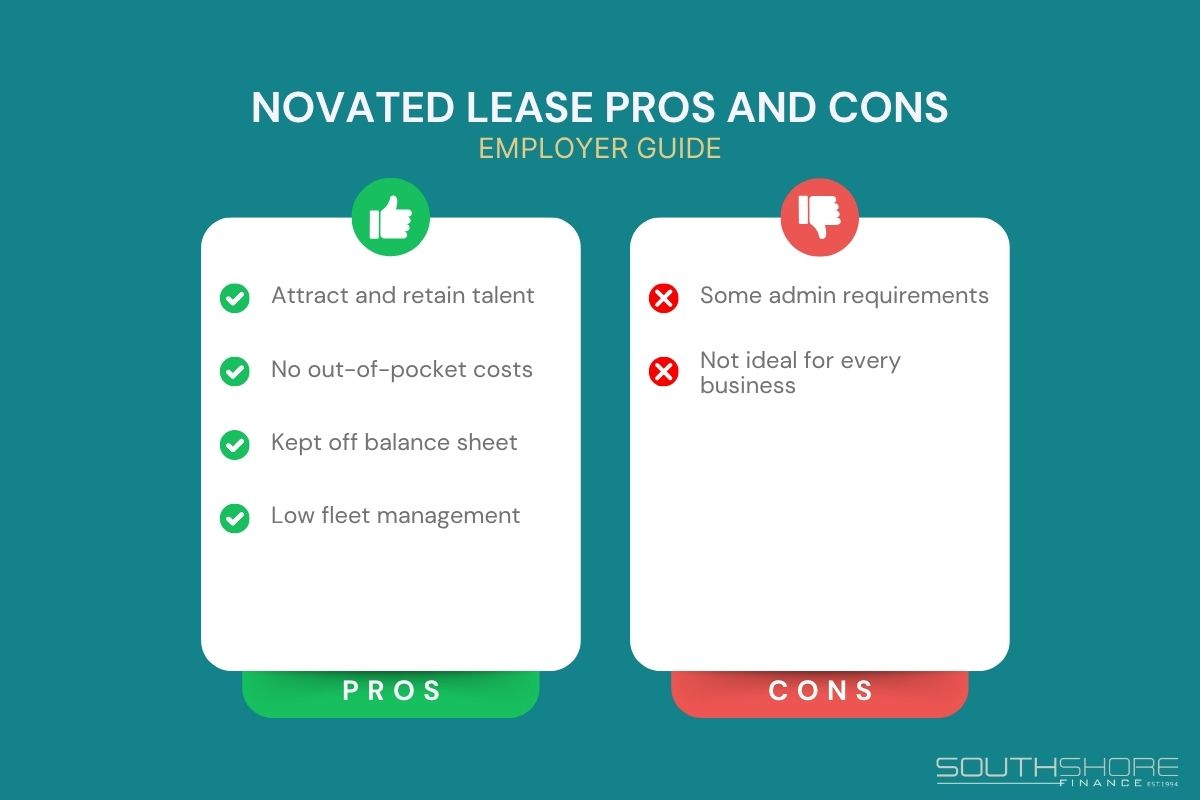

For Employers

Novated lease benefits:

- Attract and retain talent. By offering a valued, tax-effective benefit with no direct salary cost, employers can gain their advantage in the job market.

- No out-of-pocket costs. Employees cover all payments via their salary sacrifice.

- Off-balance-sheet. The lease won’t impact your company’s assets or liabilities.

- Less fleet management. Employees manage their own vehicles.

Potential disadvantages:

- Some admin. Reasonable admin time and compliance is required to manage deductions and Fringe Benefits Tax (FBT) reporting.

- Not ideal for every business. Small teams or high turnover may see limited value due to the use of admin and knowledge resources.

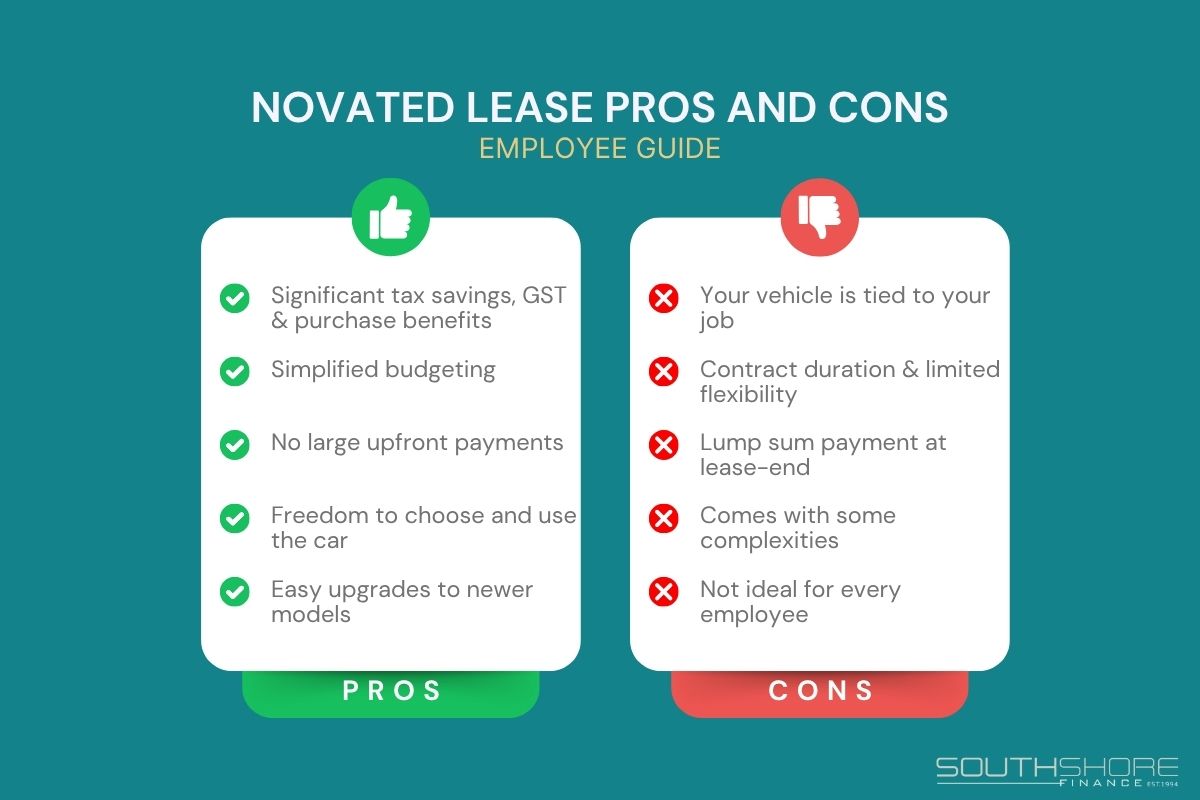

For Employees

Novated lease benefits:

- Significant tax savings. Lease payments are made from pre-tax salary, reducing taxable income and increasing take-home pay.

- Simplified budgeting. All car costs (like rego, insurance, servicing, and fuel) can be bundled into one regular payment, making expenses more predictable. One of the most popular aspects of a fully maintained novated lease is the convenience of having all running costs spread out across the year. Payroll deductions can cover everything from loan repayments to tyres and fuel, helping with personal budgeting. You estimate your annual running costs at the start of the lease, and the deductions are adjusted as needed throughout the term — for example, if your driving habits change.

- GST and purchase benefits. Employees can avoid paying GST on the car and running costs while often accessing fleet pricing through the lease provider.

- Freedom to choose and use the car. Employees can pick the car they want and use it for both work and personal driving, without restrictions.

- Easy upgrades to newer models. Leases typically run for 3–5 years, giving employees the option to upgrade to a new car regularly with minimal hassle.

- No large upfront payment. Most leases require little or no deposit, so employees can get a new car without needing large savings upfront.

Potential disadvantages:

- Connected to your job. If you leave your employer or have a gap in employment, you lose the salary sacrifice benefits and may be required to cover lease costs from your post-tax income.

- Contract duration. Novated leases are fixed-term agreements. Ending the lease early can come with costly exit fees or payout amounts.

- Lump sum payments. A residual (or lump sum) payment is due at lease-end, which can be a financial shock if not planned for.

- Comes with complexities. Understanding FBT, lease structures, and regular reconciliations may feel overwhelming for some employees.

- Limited flexibility. Once the lease is in place, changing cars or adjusting the package can be difficult without financial penalties.

- Not ideal for every employee. The tax and cost benefits are best for higher-income earners and those with moderate to high car usage.

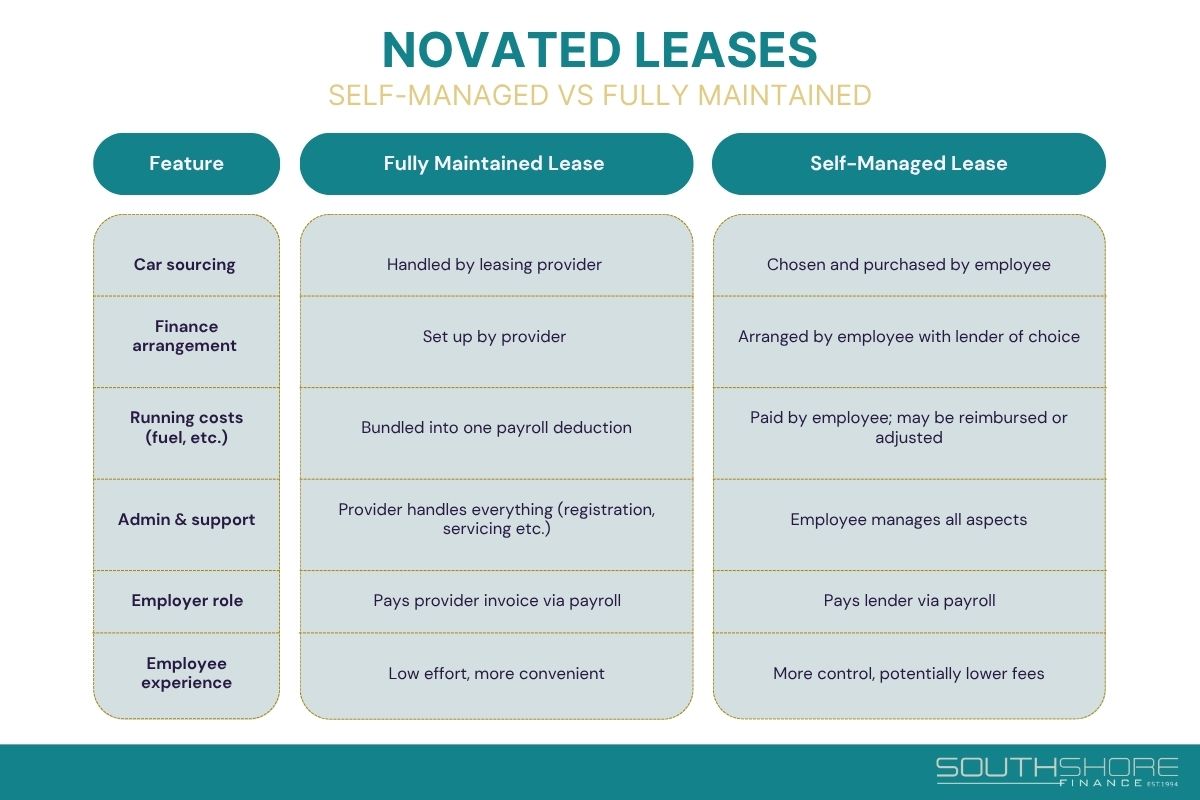

What Is a Self-Managed Novated Lease?

A self managed novated lease gives the employee complete autonomy over the lease. They take full responsibility for sourcing and securing a vehicle, which can include arranging finance and insurance.

The employee will have to draft their own budget to cover the running costs of the vehicle before completing all the necessary paperwork to set up a pay deduction with the employer or salary packaging provider.

Once the equipment finance is set up, the employer and employee enter into a novation agreement, allowing the lease repayments to come from the employee’s pre-tax salary, delivering the same tax benefits as a fully maintained lease.

How It Differs From a Fully Maintained Lease

If you opt for a fully maintained lease, the finance company will manage every stage of the process, from sourcing and securing a vehicle to arranging finance and planning your budget for routine running costs. Some employers agree to provide you with a fuel card so you don’t have to claim any reimbursements for fuel.

Benefits of a Self-Managed Novated Lease

A self-managed novated lease suits employees who want more control and flexibility, and may prefer to avoid admin fees. It still offers the same tax savings but requires more effort to manage. Employers can offer either option, but it’s wise to have a clear policy in place.

What Happens at the End of a Novated Lease?

At the end of a novated lease, the Australian Tax Office requires that there be a residual value remaining on the lease (this is by design, to ensure the arrangement isn’t just a disguised purchase). This residual is effectively a balloon payment – a final amount that was not paid off during the lease term. The percentage residual value is set based on ATO guidelines according to the length of the lease.

The employee must choose how to handle this final amount. Common options include:

- Pay the residual and keep the car: The employee buys the car outright by paying the residual value, becoming the full owner.

- Sell or trade the car: They can sell the car privately or trade it in. If the sale value covers the residual, the lease is paid out with no out-of-pocket cost.

- Refinance or re-lease the residual: If they want to keep the car but can’t pay the lump sum, they can refinance or enter a new lease to spread payments over time.

- Upgrade to a new car: Many employees trade in their current car to cover the residual and start a new novated lease with a new vehicle.

What Employers Need to Know:

- You’re not responsible for the residual payment. Your role is simply to stop or continue salary deductions, depending on what the employee decides.

- Most leasing providers notify both the employee and employer as the end date approaches, but it’s helpful to encourage the employee to plan ahead.

- Employees can’t walk away from the car without settling the residual.

How Novated Leases Compare to Other Equipment Finance Options

Novated leases are one of several ways businesses can provide vehicles or equipment. A novated lease provides the specific purpose of enabling employees to finance their own car through salary sacrifice, but it is not the only equipment finance option available to employers.

Novated Lease vs. Company Car

A company car is purchased or leased in the business’s name and provided to an employee for work and (often) personal use. The business covers all expenses such as loan repayments, fuel, servicing, insurance, and registration. Key features:

- Personal use triggers Fringe Benefits Tax (FBT), which the business must manage and pay.

- The vehicle appears on the company’s balance sheet as an asset (and liability if financed).

- If an employee leaves, the company retains the vehicle and must reassign or sell it.

Key advantage |

Key disadvantage |

| Tight control over vehicle use, branding, and safety – ideal for fleet vehicles, delivery vehicles, or where business branding is important. | High cost and admin burden for the business, plus potential FBT liability if personal use is exercised. |

Novated Lease vs. Car Allowance

A car allowance is a taxable cash payment added to an employee’s salary, intended to help them cover vehicle expenses. The employee chooses and pays for the car entirely on their own. Key features:

- No employer responsibility for vehicle ownership, maintenance, or Fringe Benefits Tax.

- Simple to implement as it only requires an additional salary line.

- No structured tax benefit for the employee.

Key advantage |

Key disadvantage |

| Very easy for employers to offer – no contracts, no admin, and no FBT risk. | As a car allowance is fully taxable for the employee, it seems less valuable than a structured lease with tax benefits from the employee’s perspective. |

Novated Lease vs. Equipment or Commercial Vehicle Finance

Commercial vehicle finance is used when your business needs to purchase or lease assets for operational use — such as machinery, IT equipment, delivery vehicles, or trucks. In this case, the finance is taken out in the business’s name, and the company is fully responsible for repayments and ongoing costs. Key features:

- The asset appears on the company’s balance sheet and may be eligible for tax deductions (e.g. interest and depreciation).

- The business retains ownership or control of the asset, even if the employee using it leaves.

- Repayments, insurance, and maintenance are business responsibilities

Common finance types include chattel mortgage, hire purchase, finance lease, and operating lease. Learn more about these commercial vehicle finance options on our equipment finance page.

Key advantage |

Key disadvantage |

| Helps the business finance essential equipment while retaining full control and access to tax deductions. | Increases business liabilities and uses capital or credit capacity that could be reserved for other investments. |

Taking the First Step With a Novated Lease

Working with a finance broker for your equipment finance needs not only saves valuable time but also ensures you have access to competitive lender prices.

At Southshore Finance, we help Perth businesses grow their business with a range of personalised equipment finance services, including an extensive network of major lenders. Being one of Perth’s most established commercial finance brokers, our experienced team is dedicated to ensuring you secure the right equipment loan with the best terms for your business.

Contact us today for a no-obligation phone consult and let’s pave the way for your business growth.