In a move that has the potential to reshape the Australian pharmacy industry, Sigma Healthcare Limited and Chemist Warehouse Group Holdings announced a merger agreement on December 11, 2023.

If it is approved by the Australian Competition and Consumer Commission (ACCC), this merger would see the two most significant players in the pharmacy industry, each with their own extensive networks and reach, join together to control more than 50% of the market share in Australian retail pharmacies. The deal would also give Chemist Warehouse its own pharmaceuticals wholesaler, allowing the merged entity preferential access to its wholesale products.

Understandably, this announcement has left many independent pharmacy professionals feeling anxious about the impact on their livelihood and well-being.

While burnout is often discussed in the context of doctors and nurses, it isn’t recognised often enough that pharmacy professionals are just as susceptible to the stresses and demands of the healthcare industry.

Southshore Finance has a long history of providing healthcare and pharmacy finance services in Perth, so we are keenly aware of the magnitude of concerns that are coming from pharmacy professionals right now.

That’s why, in this article, we will explore what you need to know about the merger, its potential impact on independent pharmacies, and offer some suggestions on how our healthcare financing services may be able to help alleviate financial burdens and stress, empowering pharmacy professionals to adapt, prioritise their well-being, and continue providing exceptional patient care.

What is the Sigma-Chemist Warehouse Merger?

Sigma Healthcare Limited is a prominent wholesale distributor of pharmaceutical products to pharmacies throughout Australia. The company also operates as a franchisor, overseeing around 400 pharmacies under well-known brands such as Amcal, Discount Drug Store, PharmaSave, and Guardian.

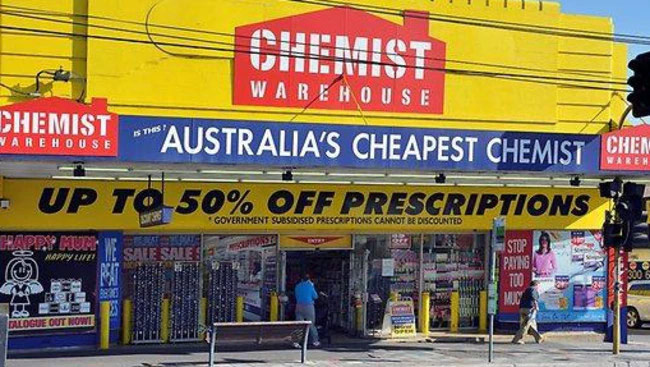

Chemist Warehouse Group Holdings, on the other hand, is a significant franchisor in its own right, with approximately 600 pharmacies and retail stores under various brands. Additionally, the company acts as a wholesaler and distributor to its franchisees, further extending its influence within the industry.

Under the terms of the agreement, Sigma will acquire all shares in Chemist Warehouse, with Chemist Warehouse shareholders receiving Sigma shares and a substantial $700 million in cash. Once the merger is finalised, Chemist Warehouse shareholders will hold a majority stake of 85.75% in the merged entity, which will be listed on the ASX. Sigma shareholders will hold the remaining 14.25%.

This $8.8 billion merger has been criticised for being “innovative for all the wrong reasons” and appearing to be closer to a reverse takeover than a true merger.

Why It’s a Big Deal for the Pharmacy Industry

The coming together of these two industry giants has far-reaching implications for the pharmacy sector, raising significant concerns about potential market dominance and reduced competition.

Sigma and its competitors EBOS and API already control 90% of the pharma wholesaling market. Now, with the merged entity estimated to control over 50% of the retail pharmacy market share, independent pharmacies may find it increasingly difficult to compete.

If the merger is approved by the ACCC, Chemist Warehouse-Sigma would control over 1,000 retail stores and 16 distribution centres in Australia and New Zealand, making them the biggest pharmacy group in the country and one of the biggest retail companies in Australia.

Recent US history has shown that when pharmaceutical companies consolidate, it often leads to reduced competition, higher prices, and a decline in patient care.

Industry stakeholders have voiced their apprehensions about the merger.

On the 7th of December 2023, the Pharmacy Guild of Australia expressed concerns about the availability of wholesale drugs for community pharmacies and the increasing corporatisation in the sector:

“The Pharmacy Guild of Australia believes the apparent imminent takeover of Sigma Healthcare by Chemist Warehouse poses significant questions and risks. These questions and risks relate to patient care, community pharmacy ownership, competition, and the future of CSO wholesaling which Commonwealth, State and Territory Governments together with regulators, like the Australian Competition and Consumer Commission (ACCC), need to urgently consider and address.”

While Chemist Warehouse and Sigma claim they are merely franchisors and that pharmacies are owned by independent proprietors, industry bodies remain concerned about the merger’s impact on competition and patient care. Supporters of the merger argue it may lead to lower drug prices through discounting and supply chain efficiencies, but concerns remain that it may come at the cost of smaller pharmacies’ ability to compete.

Navigating the Changing Landscape as an Independent Pharmacy

Independent pharmacies are likely to face significant challenges in a post-merger landscape.

Competing on price and access to products may become increasingly difficult as the merged entity leverages its scale and market dominance.

This raises additional concerns that the increased market pressure resulting from the merger may exacerbate burnout among pharmacy professionals.

While there is no easy solution, Southshore Finance would like to extend a helping hand and encourage pharmacy professionals to consider seeking independent financial advice.

Working with an experienced finance broker can provide tailored solutions to help pharmacies adapt to the evolving market conditions.

At Southshore Finance, our experienced team of finance brokers has been serving Perth for over 30 years. Our top priority has always been and will always be to offer the best recommendations for your current circumstances. While we have relationships with all major Australian lenders, including banks, finance companies, building societies, and insurance companies, first and foremost, we work for you.

We offer a wide range of healthcare financing services, including options for practice purchases, expansions, refinancing, equipment loans, fit-outs, and working capital. We also provide personal funding solutions for pharmacy professionals. Learn more about our Pharmacy and Healthcare Finance services today.

Let us work with you to make informed decisions, invest in your growth, and help you feel confident that you’re well-positioned to weather the challenges ahead.